Uncategorized

Teamsters Let Congress Know It’s Time to Act on Central States

Capitol Hill staffers learned today what the Teamsters have known for some time – that proposed cuts to the Central States pension plan are a non-starter that won’t save the fund and will devastate tens of thousands of workers across the Midwest.

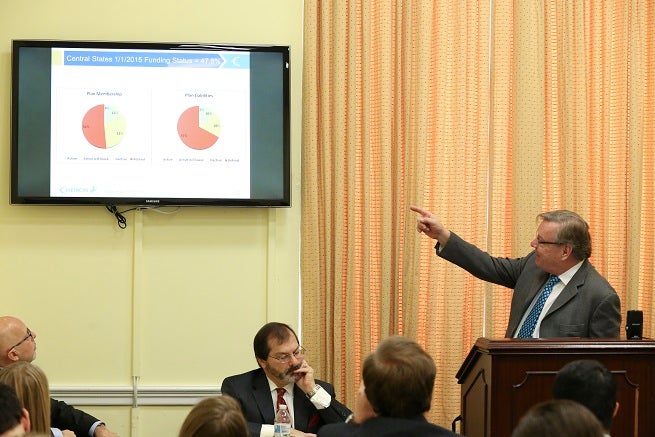

Teamster representatives briefed a standing room only audience of congressional aides on the dire proposal by Central States submitted last October. They noted the pension fund is totally unrealistic in its projections and that even if it were to meet them, Central States itself says there is only a 50 percent chance the fund would remain solvent long term.

John Murphy, IBT International Vice President-East and Secretary-Treasurer of Local 122, said if the Department of Treasury looks closely at Central States’ numbers, it can’t allow the proposal to move forward. He also said lawmakers were unfamiliar with the language of the Multiemployer Pension Reform Act (MPRA) included in an omnibus appropriations bill in late 2014.

“Treasury must reject this plan,” he said. “We believe members of Congress were hoodwinked by this plan. There was not one hearing on the language of this law.”

Noting the importance of a secure retirement for everyday Americans, Murphy said the federal government must step in and take charge on the issue. “This is not a union issue, this is not a Republican issue, this is not a Democratic issue,” he said. “It’s a fairness issue.”

Rep. Debbie Dingell (D-Mich.), who sponsored the event, said increasing congressional knowledge of the problem is essential. “I don’t think they understand what this is doing to peoples’ lives,” she said.

The numbers just don’t add up when it comes to Central States proposal, said David Blitzstein, who for more than 30 years has worked on behalf of worker pension funds. For instance, it depends on a 7.5 percent return on invest on average. But the fund has lost about $2 billion in value since the June 2015 numbers used in the report. Quite simply, there is no way to gauge whether the stock market will be able to hit such numbers over the long haul.

In addition, he noted that Central States’ application presumes employers will continue to increase their pension contributions between two and four percent each year. That means 50 years from now, they will be paying $848 a week in pension payments for each employee alone.

“That’s not going to happen,” Blitzstein said. “What this tells you is it’s a totally unreasonable economic assumption.”

Members of Congress have begun to take notice. A bipartisan collection of 84 House members and 25 senators signed onto separate letters calling on Treasury to reject the proposal.

The Treasury Department has until May 7 to make a final decision on Central States’ pension plan. But it shouldn’t need that long. This proposal is broken. Instead, it’s time for the federal government to step up and fix the pensions of retirees as it is supposed to under the law.